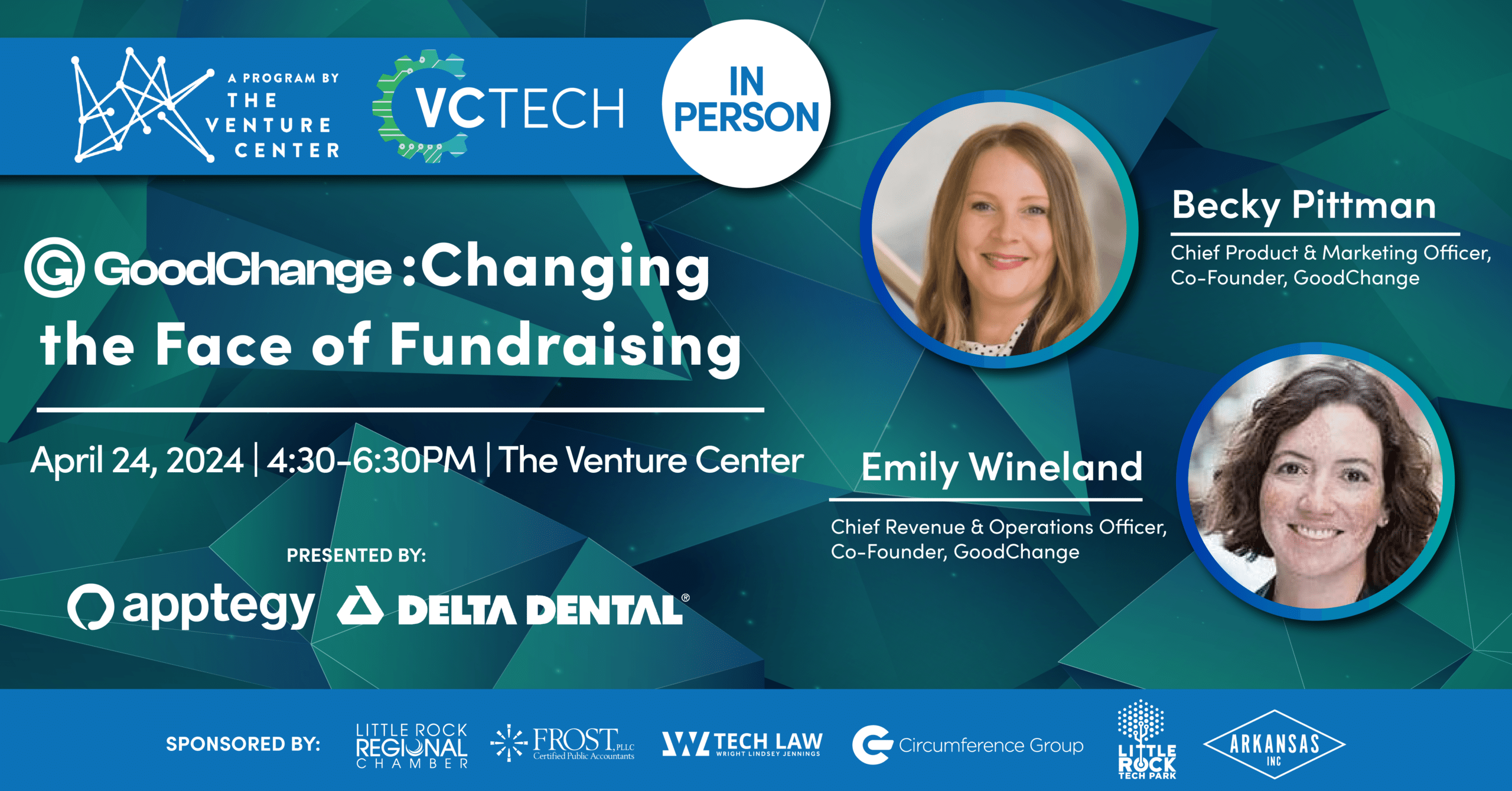

VCTech-GoodChange: Changing the Face of Fundraising

The Venture Center 417 Main Street, Little Rock, AR, United StatesWe're excited to announce our upcoming VC Tech series featuring the innovative product GoodChange and its co-founders, Becky Pittman and Emily Wineland, from Level Wins. This educational series, designed for technology startups, offers a platform for sharing business journeys, navigating challenges, and connecting with industry experts.