Day 2 of VenCent Summit 2023: French Hill to Speak on Digital Asset Regulations

by Lara Farrar

Read the original article here

Update: French Hill Discusses Finance, Digital Asset Regs

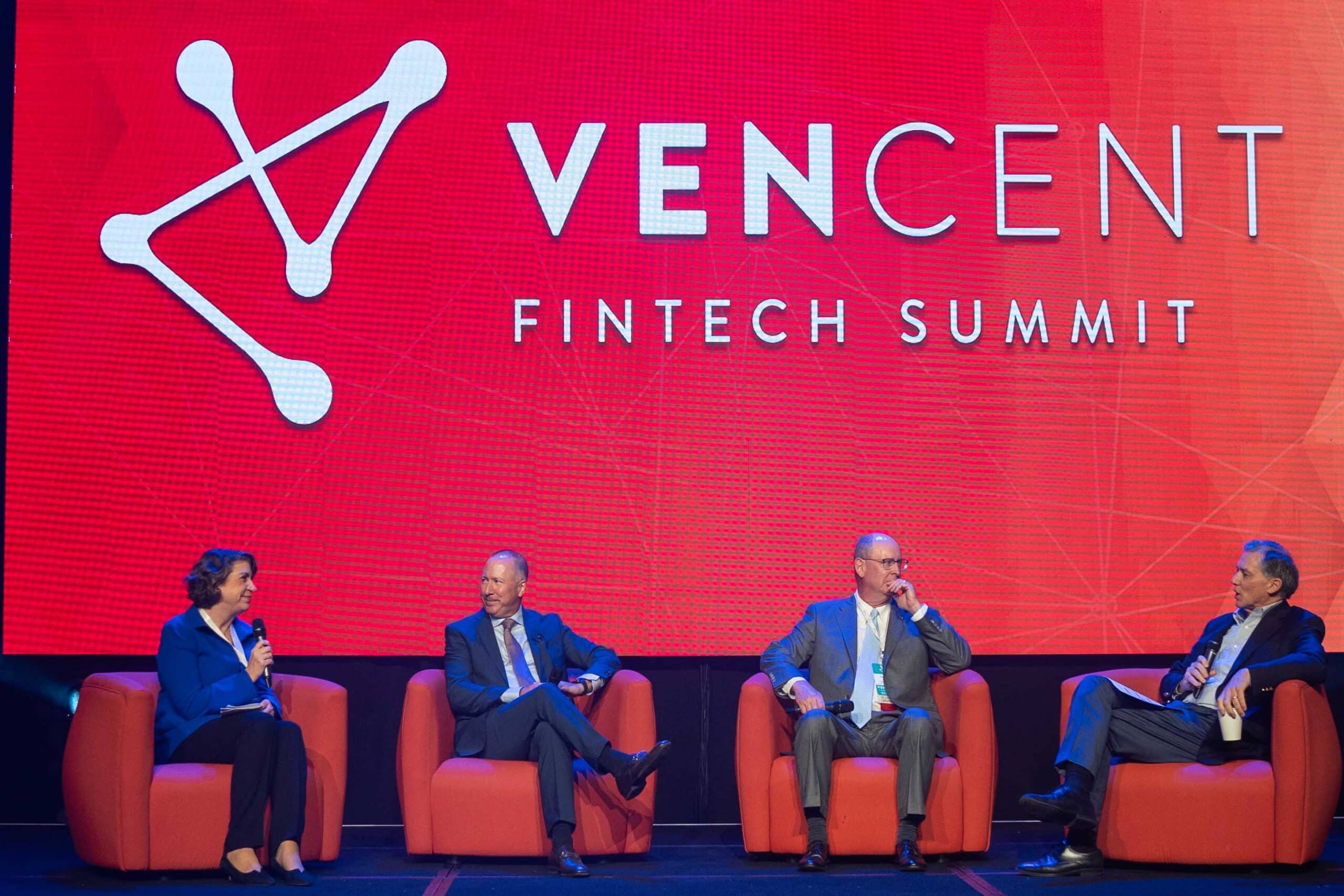

In a panel discussion on the summit’s second day, Republican U.S. Rep. French Hill slammed the Biden administration and its policies for regulating digital assets, like cryptocurrencies.

Attempts to regulate digital assets have been “sheer chaos,” Hill said. The U.S. SEC is forcing American companies to move offshore.

There are substantial parts of the American population who want to experiment with Web3 and block chain, and “they don’t know what the rules are.”

“It does not make any difference if you are a crypto bro or a crypto skeptic,” Hill said. “The one thing that is 100% true is the status quo is a failure. The one thing I have learned in business is if you stick with the status quo, you are losing.”

Update: Banking Execs, Entrepreneurs Discuss Cybersecurity, Fraud

Aside from afternoon panel discussions focused on lending and payment solutions, VenCent participants had the chance for one-on-one meetings with banking executives where fintech entrepreneurs pitched their solutions in hopes of creating new business partnerships.

A late afternoon session just started with entrepreneurs pitching their business ideas for fraud, anti-money laundering and cybercrimes.

The session kicked off with a presentation from Kendall Reese, Simmons Bank senior vice president and chief information security officer.

Reese discussed increased threat activity. The frequency of data breaches for the first half of this year is more than the number made in any full year the past decade, he said. “The two industries with the most compromises [are] financial industry and healthcare,” Reese said.

Motivations for attacks have changed over time, Reese said. Hacker communities are now “far more dangerous.”

“State sponsored actors are well-funded, intelligent and patient,” Reese said.

The banking executive said more collaborations are needed to fight off threats. He also said that businesses rely on sometimes more than 100 different types of cybersecurity tools, which are cumbersome and hard to manage. “No more single-purpose tools, please,” Reese said.

Tim Medin, CEO of Red Siege Information Security, a firm that companies hire to find weaknesses in network systems, said passwords are one of the most common ways for security breaches.

“The real bad guys are getting in because of re-used passwords,” Medin said. “The passwords are the most common way [hackers] are getting in these days. If you look at the modern research, it is that over and over again.”

Using password managers can make it harder for breaches, he said.

“Time and time again [passwords] are the original access method,” Medin said, adding that phishing also remains a top way for hacks.

Update: 2023 Participants in FIS Fintech Accelerator Present Business Pitches

Entrepreneurs selected to take part in the FIS Fintech Accelerator Program began presenting their business solutions. Participants have 7 minutes to pitch their ideas.

Omri Yacubovich presented Lama AI, a solution making it easier for small businesses to obtain bank loans in less than 7 minutes. Eighty percent of small business loan applicants are denied, Yacubovich explained, “but there is also a constant need for capital.”

Rod Boothby, CEO and co-founder of ID Partner Systems, explained how his company creates an online real identification system using banks to verify an individual’s identity. “The proposal is to let people control their identity by creating a bank-based ID.”

Update: Hugh McDonald Opens Conference

Arkansas Commerce Secretary Hugh McDonald opened the first day of the conference, which has about 300 attendees this year. McDonald spoke about the success of the FIS Fintech Accelerator Program. Each year, FIS Global of Little Rock, in partnership with The Venture Center of Little Rock, selects 10 growth-stage fintech companies to take part in a three-month mentoring program. That program began in 2016.

“You have no doubt heard about the track record of this event,” McDonald said. “Since 2016, nearly 100 companies have been created from the fintech accelerator. Eighty-five percent of them are still in operation. The average capital raise was $17 million and $2.5 billion of capital has been raised in total. There are three companies now valued over $1 billion.”

McDonald continued: “Opportunities abound. We wish you the best of luck in repeating those awesome trends. We are hoping you keep coming back, keep innovating, solving problems and identifying solutions.”

The VenCent Fintech Summit is underway in Little Rock today, with keynote speakers Gov. Sarah Huckabee Sanders and Hugh McDonald, secretary of the state Department of Commerce.

It’s the second year of the two-day summit, which brings together banking leaders and fintech innovators from the U.S. and abroad to discuss challenges and opportunities in financial technology.

This year’s summit will feature a VenCentMatch, which, similar to speed dating, connects bankers and fintech leaders to forge new partnerships.

More than 400 people attended the inaugural summit last year. Arkansas Business is covering today’s events and will have more at arkansasbusiness.com later today.