By CBI of Central Arkansas

Originally published July 15, 2020, reposted with permission

According to aarp.org, in 2011 the first of the baby boomers reached “what used to be known as retirement age,” or 65 years of age. Since 2011 – and for what is expected to be the next 14 years – about 10,000 people will turn 65 years old each day. Many of these boomers own businesses, and have spent much of their lives building and running that business to provide a living for themselves, their family– allowance, cars, tuition, etc. – and their employees. All of a sudden it’s time to think about what to do next. It’s an emotional process to be sure. There is also an inherent conflict which lies in running a business to provide a living, verses running a business you know you are about to confidentially put on the market.

Oftentimes this can mean eliminating certain “perks” that may not be business related expenses. These “perks” take on all kinds of different forms – some legitimate, others not so much. By trimming this fat it will add to the bottom line of the business. In addition, it will clean up the books for due diligence. The buyer, and the lender, will appreciate this. And what you pay in taxes will be more than made up by the increase in value and what is received once the deal closes. While cash flow involves much more than just the net income, the net income does provide the foundation upon which the cash flow is built. A sturdier foundation, ie, bigger net income, will lead to a healthier cash flow, which will lead to a more valuable business, which will ultimately result in more money in your pocket.

Another important factor to consider is your role in the business. Are you THE business? While this does not make one’s business “unsellable” – it does limit the pool of buyers available. Buyers want to know they will be able to succeed in the business without the owner’s presence. Any owner should be prepared to train a new buyer, but if you ARE the business, it makes that transition process all the more important – and the type of buyer more difficult to find. Such businesses typically depend heavily on personal relationships with customers, and the seller should be prepared to make the necessary introductions. Buyers also want options. If you are the business that limits their options. Should they want a manager it will hurt the existing cash flow and create added difficulties in hiring the right person. By transitioning a key person to fill your role right now, you put that person in place already, and increase the pool of buyers that will look seriously at your business. Having a key person makes your business attractive not only to the buyer that wants to dive in and run it himself, but also the buyer that seeks to manage a business and requires a key person/manager. You’ve thought ahead and transitioned your business to accommodate both types of buyers – maximizing the value of your business and increasing the likelihood of a satisfactory transaction.

Of course these are only a couple of the many factors involved in selling a business, but two very important factors in determining value. The most valuable thing a business owner can do, however, is plan ahead and be ready when the time comes – which also means being ready for the unexpected.

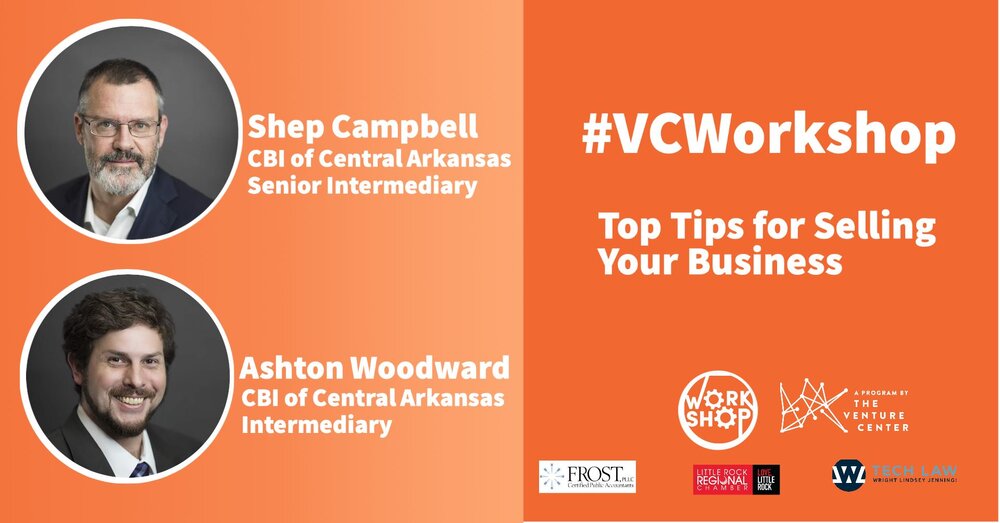

To learn more about how to sell your business and find your value, register for the FREE #VCWorkshop | Top Tips For Selling Your Business Tuesday, August 18, at 11:30AM CST.

Originally posted by M&A Advisors July 15, 2020.

Want to learn more?

Join us Tuesday, August 18 from 11:30am – 1:00pm for #VCWorkshop | Top Tips for Selling Your Business with CBI of Central Arkansas’ Shep Campbell and Ashton Woodward, and get ready to sell big!